China's Ghost Towns:

Over-development in the

Real Estate Market

| 22 August 2011. Some say that the best expression of excess capacity and overdevelopment in China is its real estate market. With nominal interest rates going at a pittance, stringent capital controls and volatility in China's equity markets, there seems to be no real alternative outlets for the nation of savers (China saved 50 percent of its GDP in 2010) and it is therefore no huge wonder that investors have turned to real estate as investment options. Click here to continue reading. |

|

| S |

Negative real interest rates for savers are at the heart of what many believe is a burgeoning property bubble. With nominal interest rates going at a pittance, stringent capital controls and volatility in China's equity markets, there seems to be no real alternative outlets for the nation of savers (China saved 50% of its GDP in 2010) and it is therefore no huge wonder that investors have turned to real estate as investment options.

Away from the bright lights of glitzy urban centers like Beijing and Shanghai, newly built city centres, such as those in Zhengzhou and Tangshan, have popped up on maps, in a race to join in the building boom.

Regards,

akshintala.Dharmendra

http://nsemantra.blogspot.com/

The Size Of The U.S. Public Debt: Are The Rating Agencies Fools or Knaves – by Prof. John Weeks- - Technical view...

0 comments Posted by Nse at Friday, August 19, 2011

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gold to peak at $1,900/oz in next six months: GFMS

0 comments Posted by Nse at Friday, August 19, 2011

Gold to peak at $1,900/oz in next six months: GFMS

--

Gold could hit USD 1,900 an ounce in the next six months, driven by buyers seeking an investment safe from global economic problems, but a further rise to USD 2,000 looks unlikely, metals consultancy GFMS said on Thursday.

"Gold will be muddling through to peak at USD 1,900 (an ounce) as US data points have been ambiguous, the action on the fiscal and monetary front is also ambiguous," said Paul Walker, global head of precious metals at GFMS, which was acquired by Thomson Reuters recently.

Gold extended record highs above USD 1,825 an ounce on Thursday after poorly received US jobs data hurt assets seen as higher risk, such as stocks, while boosting interest in nominal safe havens such as gold.

"In the timeframe, we really need exceptionally dramatic news to push gold above USD 2,000 and this is not our base case." said Walker. "This is highly unlikely."

He said there was a high probability of India's gold imports crossing 1,000 tonnes this year -- up four percent on 2010 -- as expectations were for prices to gain further.

The World Gold Council in a report on Thursday said Indian gold jewellery buying was up 17% in the second quarter and that signs of strength in the market remained.

"People are getting accustomed to this kind of a benchmark (price) even though it is at incredibly elevated levels. Everybody who is involved in the value chain in the Indian gold market thinks prices will go up," said Walker, ahead of a conference in Kerala.

Silver prices could extend gains to USD 50 an ounce in the next months from around USD 40.6 an ounce now, he added.

"It will follow gold up ... It will move towards USD 50, but it is going to be a hell of a lot more volatile," said Walker.

Regards,

akshintala.Dharmendra

http://nsemantra.blogspot.com/

India will become a $5.6 trillion economy by 2020

0 comments Posted by Nse at Wednesday, August 17, 2011. - Tree House Education & Accessories Ltd

Tree House is entering in the capital markets with an initial public offering, IPO of 8,432,189 Equity Shares of Rs 10 each. The price band for the issue will be decided at least two working days prior to issue opening date. CRISIL has assigned an IPO Grade 3 to Tree House Education IPO. This means as per CRISIL, company has 'Average Fundamentals'.

Tree House Education is one of the leading educational services providers in India. As per CRISIL report, they operate the largest number of self-operated pre-schools in India. They have 177 pre-schools under the brand name of "Tree House" across 23 cities in India.

The issue opens on Aug 10, 2011 and closes for subscription on Aug 12, 2011. The equity shares of the issue are proposed to be listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

Visit Tree House Education IPO page for Tree House IPO Detail, Tree House Education IPO GMP, Tree House IPO Premium and Tree House Education IPO Reviews.

2. Upcoming IPO - SRS Limited

SRS Limited is entering in the capital markets with an initial public offering, IPO of 35,000,000 Equity Shares of Rs 10 each. The price band for the issue will be decided at least two working days prior to issue opening date.

SRS Limited is engaged in the business of Cinema Exhibition, Food & Beverages, Retail and Manufacturing & Retailing of Jewellery operations. Company operates 23 retail stores, 15 food courts and 30 cinema screens in North India. The company also operates five jewellery retail and wholesale outlets and a jewellery manufacturing unit in Delhi.

The issue opens on Aug 23, 2011 and closes for subscription on Aug 26, 2011. The equity shares of the issue are proposed to be listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

Regards,

akshintala.Dharmendra

http://nsemantra.blogspot.com/

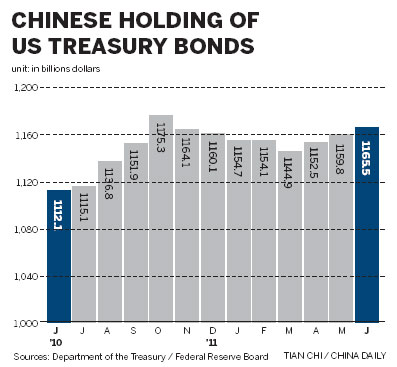

aninvestment described by one expert as "the best of a bad bunch", amid growing calls for

thecountry to diversify its foreign reserves.

Labels: MARKET NEWS

L&T Finance Holdings IPO allotment status is now available online.

0 comments Posted by Nse at Wednesday, August 17, 2011L&T Finance IPO was open on Jul 27, 2011 and closed on Jul 29, 2011. IPO was oversubscribed by 5.34 times (9.61 times in retail) on closing day.

Visit http://www.chittorgarh.com to check your application status.

Regards,

akshintala.Dharmendra

http://nsemantra.blogspot.com/

Regards,

akshintala.Dharmendra

http://nsemantra.blogspot.com/

Tree House Education and Accessories Ltd (THEAL) - AVOID

0 comments Posted by Nse at Wednesday, August 17, 2011About Company

THEAL is one of the educational service providers in India, which mainly operates in pre-school segment and provides educational services to K-12 schools in India. As of 15th June 2011, the company have 223 pre-schools (149 – self operated and 74 thru franchisee) spread across 33 cities under the brand name of "Tree House". As of 31st March 2011, the company's self operated pre-schools has 5000 students in the age group of 1.5-6 years and has team of 370 teachers with teacher to student ratio at 1:14. In K – 12 segment, as of 31st March 2011, the company provides educational services to 12 schools, which has over 5000 students, in 4 cities in India.

• Issue-open date:10th Aug 2011 & Issue-close date:12th Aug 2011

• Retail Discount: Rs 6/share

Valuations

At the lower price band of Rs 135/share, the stock is trading P/E of 37.1x and 49.5x (based on FY11 earnings) on pre-issue and post-issue capital respectively. At upper price band of Rs 153/share, the stock is trading P/E of 42.1x and 56.1x (based on FY11 earnings) on pre-issue and post-issue capital respectively. Even, if we assume the PAT to grow at 100% in FY12E, the stock will trade at P/E of 24.7x FY12E earnings on post-issue capital and lower price band. Although, the business model is good with stable earnings profile, we believe in current uncertain environment, such higher valuation is unjustified. We believe investors will get an opportunity to buy the stock cheaper post listing and therefore recommend AVOID to the issue. (Since, we don't have subscribe rating on the stock, we will not issue detail note).

Regards,

akshintala.Dharmendra

http://nsemantra.blogspot.com/