US crisis inquiry points to widespread failures

| ||

| ||

Labels: gold

Gold

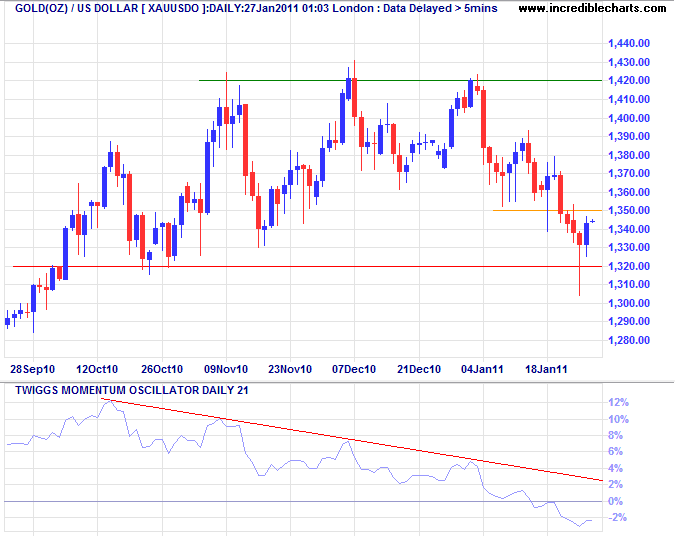

The weakening dollar is likely to strengthen precious metals and commodity prices. Gold found support at $1320, evidenced by the long tailtwo days ago. Twiggs Momentum (21-day) remains below zero, warning of a correction; only recovery above the declining trendline would negate this.

|

Labels: inflation

| 10th January 2011 | ||||||||||||||||||

| ||||||||||||||||||

Let us begin with the good news. Economic growth in India continues to present a happy story. Even if we take the highly volatile IIP, which has consistently shown lower growth since the peak of 15% growth in the Jan-March 2010 quarter, manufacturing is expected to turn in a 9% growth in 2011-12. The service sector is expected to grow by close to 11% next year, as trade, transport, communication, hotels, finance etc. are all set to continue their robust growth. Apart from all the usual indicators of production and economic activity, the improvement in the hiring indices across all sectors is a pointer to firms turning back to their expansion plans. Salary hikes are also on the way up, not yet to the peaks seen during the boom years, but significantly higher than the past year. Now for the bad news. Though all inflation indices show falling inflation rates, as we, at Indicus, have been saying for the past two years, inflation is not on its way out. This will not be news to the households who are grappling with high price spikes in basic food and fuel goods, nor will it be news to companies who feel the pinch coming in back again through inputs and commodities, nor will it be news to the RBI whose eagle eye is forever trained on inflationary pressures – it will however probably be news to the government, who has been seemingly unaware of the omnipresent pressure points in the system. Take the ongoing onion spike as a perfect example of apathy – when un-seasonal rains hit crops, is it really so difficult to predict and take appropriate action against impending shortfalls in supply? Emerging onion short supply was well-known months back, corrective action could very easily have been taken then. Why did we not? And why does this happen repeatedly? Now going ahead, crude oil prices have moved up, again a trend that has been on the cards for a few months now, cement, steel and other commodities have pushed up as well while prices in the auto sector and consumer durables are now set to factor in these rises in input prices. To make matters worse, it is not just domestic prices but global food and commodity prices that are trended up. Whether it is sugar or iron ore, the story is the same, we are to expect higher prices ahead. Now in such a situation, is it feasible to look forward to a benign inflationary environment in 2011? We anticipate consumer price inflation to stay (at best) around the 8-9% range in the year ahead. Clearly there are structural issues at play here that need to be dealt with, especially when it comes to food – anticipating the implications of erratic weather, higher productivity, better storage, processing, market reforms, the list is long and well known. There are of course other reasons lending a hand to inflationary pressures, as we have said all along, the higher fiscal deficit necessitated by the crisis is one of them, government programmes that have boosted rural incomes through higher MSPs is another and so on. And then there is all the cash floating around as high government expenditures on infrastructure and social spending brings with it the baggage of what has always euphemistically been termed ‘leakages’. So the economy is heating, though thankfully it is under some control. But the RBI has a tough job ahead. Of course, a better fisc and efficient food management could make its life easier, but the government is either unwilling or unable to oblige. | ||||||||||||||||||

| Sumita Kale and Laveesh Bhandari | ||||||||||||||||||

10th January 2011, Indicus Analytics | ||||||||||||||||||

Sumita Kale is Chief Economist, and Laveesh Bhandari is Director, Indicus Analytics. They can be contacted at sumita@indicus.net andlaveesh@indicus.net | ||||||||||||||||||

Click to leave comment | ||||||||||||||||||

| ||||||||||||||||||

| Read:The story behind the PMI data | ||||||||||||||||||

| Read:IMF pegs India’s GDP growth at 8.75% | ||||||||||||||||||

Click to leave comment | ||||||||||||||||||

| ||||||||||||||||||

| Read: Inflation pressures rise in emerging Asia | ||||||||||||||||||

| Read: High agri commodity prices a concern: FAO | ||||||||||||||||||

| ||||||||||||||||||

| Read: China central bank says inflation a priority | ||||||||||||||||||

| Read: ECB rate hike likely sooner than expected | ||||||||||||||||||

Click to leave comment | ||||||||||||||||||

|

Labels: Emerging Economy

Subscribe to:

Posts (Atom)